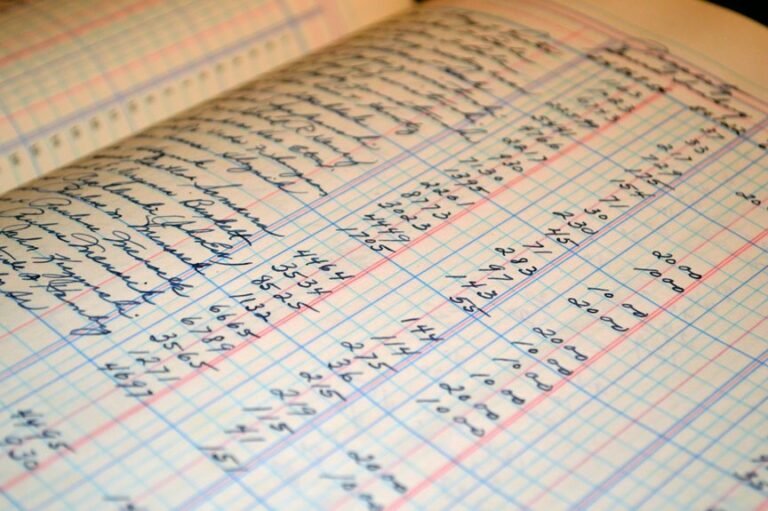

The Market Operations Log for identifiers 651760960, 968191838, 9292215050, 613953918, 643232703, and 944230045 provides a structured overview of trading activities linked to these specific financial instruments. By analyzing the data, one can identify patterns in market behavior and volatility. Such insights are crucial for stakeholders aiming to refine their trading strategies. However, the implications of these trends raise important questions about future market dynamics and investor responses.

Overview of Key Identifiers

In the realm of market operations, key identifiers serve as essential benchmarks that facilitate the tracking and analysis of various financial instruments.

They encompass unique codes, such as ISINs and CUSIPs, which enhance transparency and efficiency.

Their market significance lies in enabling investors to make informed decisions, thus promoting a more liberated trading environment where participants can navigate complexities with confidence and clarity.

Analysis of Market Trends

While various factors influence market dynamics, the analysis of market trends provides critical insights into the behavior of financial instruments over time.

Examining market volatility and price fluctuations reveals patterns that can inform future expectations. Such analysis assists investors in understanding the underlying forces driving changes, allowing for more informed decisions in a landscape characterized by uncertainty and rapid shifts.

Trading Strategies Based on Operational Patterns

How can traders effectively harness operational patterns to enhance their strategies?

By employing pattern recognition techniques, traders can identify recurring market behaviors, allowing for strategy optimization.

Analyzing historical data provides insights into potential future movements, enabling traders to make informed decisions.

This analytical approach empowers traders to navigate the market more freely, capitalizing on established patterns while mitigating risks associated with unpredictable fluctuations.

Insights and Recommendations for Investors

Recognizing the importance of informed decision-making, investors should focus on leveraging comprehensive market analyses to guide their investment strategies.

By understanding investment risks and anticipating market volatility, they can make prudent choices that align with their financial goals.

Diversifying portfolios and staying updated with market trends will empower investors to navigate uncertainties, ultimately fostering a more resilient investment approach in fluctuating conditions.

Conclusion

In the intricate tapestry of market operations represented by the identifiers, each code serves as a thread weaving resilience into the fabric of investor strategy. The patterns revealed within these logs symbolize not only the ebb and flow of financial currents but also the potential for adaptability in an unpredictable environment. By embracing these insights, investors can navigate the turbulent waters of market volatility, transforming uncertainty into opportunity, much like a sailor finding direction amidst shifting winds.