The Corporate Evaluation and Market Performance Bulletin for companies 640257791, 639876400, 919611619, 6932197615, 6097102131, and 6998292449 presents a comprehensive analysis of their financial standings. Key metrics reveal diverse profit margins and revenue trajectories, highlighting differing operational efficiencies. In a rapidly evolving market landscape, these companies must navigate various strategic challenges. Understanding these dynamics is crucial for investors seeking informed decisions in this competitive environment. What implications do these findings hold for future market strategies?

Overview of Selected Companies

An analysis of selected companies reveals significant variations in their corporate strategies and market performances.

Company profiles indicate distinct approaches to innovation, customer engagement, and sustainability initiatives.

Industry comparisons highlight disparities in market positioning and competitive advantages.

These differences underscore the diverse methodologies employed, illustrating how strategic choices shape outcomes, ultimately impacting each company’s ability to thrive in an increasingly dynamic marketplace.

Key Financial Metrics

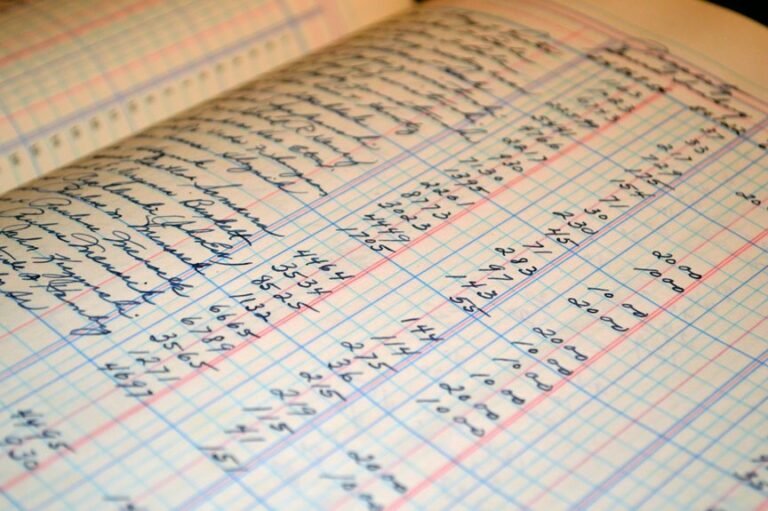

Key financial metrics serve as critical indicators of a company’s performance and overall health in the marketplace.

Profit margins reflect a company’s efficiency in converting sales into actual profit, while revenue growth signals its ability to expand and capture market share.

Analyzing these metrics provides stakeholders with essential insights into operational effectiveness and financial sustainability, guiding informed decisions about investment and strategic direction.

Market Trends and Analysis

Understanding market trends and conducting thorough analysis is vital for companies seeking to navigate the complexities of today’s competitive environment.

The interplay of market dynamics significantly shapes the competitive landscape, influencing consumer behavior and investment patterns.

Companies must remain vigilant, adapting strategies in response to emerging trends to maintain relevance and capitalize on opportunities, ultimately ensuring sustained growth and market presence.

Strategic Insights for Investors

How can investors effectively navigate the intricate landscape of corporate evaluation to make informed decisions?

By employing robust investment strategies and conducting thorough risk assessments, investors can identify potential opportunities and pitfalls.

Analyzing financial metrics, market conditions, and competitive positioning allows for a clearer understanding of value propositions, enabling stakeholders to align their portfolios with their risk tolerance and investment objectives effectively.

Conclusion

In summary, the corporate evaluation of companies 640257791, 639876400, 919611619, 6932197615, 6097102131, and 6998292449 underscores a spectrum of financial fortitude and future-focused strategies. As market dynamics dictate the need for adaptability, astute investors should assess these firms’ performance potential. By prioritizing profitability, pinpointing progressive trends, and pursuing prudent investments, stakeholders can navigate the nuanced landscape, ensuring that their financial futures flourish amidst fluctuating market forces.